Introduction

It is dividend season at the NSE. Investors are keenly watching, since dividends are one of the rewards of owning shares. Previously, we highlighted how reinvesting dividends can supercharge your returns. In this post, we discuss essential concepts regarding dividends that every investor should know.

As an investor, do you know how much dividend income you will receive? Likewise, can you differentiate between the announcement date, the books closure date, and the payment date? How about cum-dividend versus ex-dividend? No? Well, read on!

A company may elect to pay a dividend to its shareholders as a return on their investment. Nevertheless, not all companies pay dividends, and there is a wide range in amounts paid. In Kenya, most companies pay a dividend after announcing their results for the past financial year. However, some companies also pay an interim dividend when announcing their half-year results.

Key dates

An investor needs to be aware of several key dates. First, a dividend payment is usually announced with the release of a company’s financial results; this is termed the announcement date. On the next trading day following the announcement date, the stock is said to be trading cum-dividend, that is, trading with a dividend. The share price typically rises by the amount of the dividend.

If there is one date to remember regarding dividends, it is the books closure date, or record date. Shares purchased on or before the record date qualify for the dividend payment; shares purchased after the record date do not. One can, however, sell their shares after the record date and still receive payment, since whether or not one qualifies for a dividend depends only on whether you held shares on the record date. After the record date, the share price typically falls by the amount of the dividend.

As implied, the payment date is the day the actual payment is made. Usually, this is several weeks after the record date. An investor can choose to receive payment via mobile money, bank account transfer, or paper cheques sent by mail.

Examples

In case all of these dates and terms are causing your head to spin, let’s illustrate with a real life example.

On February 22 2017, Barclays Bank of Kenya (BBK), a perennial high-dividend share, announced a final dividend of Ksh 0.80 per share. The share went ex-dividend on March 30 2017, and the payment date is April 28 2017. Therefore, BBK will trade cum-dividend (with a dividend) from February 23 through March 30 2017. To qualify to receive this specific dividend, one must own BBK shares on March 30 2017. BBK will then pay you, the investor, Ksh 0.80 for every BBK share that you own. Nevertheless, note that an investor could sell all their BBK shares on March 31 2017, the first day after the record date, and still receive the full dividend. Lastly, on April 28 2017, the payment date, BBK will pay out the dividend.

While announcing the dividend, BBK was trading at less than Ksh 9.00. Thus, the final dividend of Ksh 0.80 represents a dividend yield of almost 9%, one of the highest at the NSE. Contrast this to banks and bonds which pay about 10% per year, with no possibility of asset appreciation, and you will understand one of the strengths of shares.

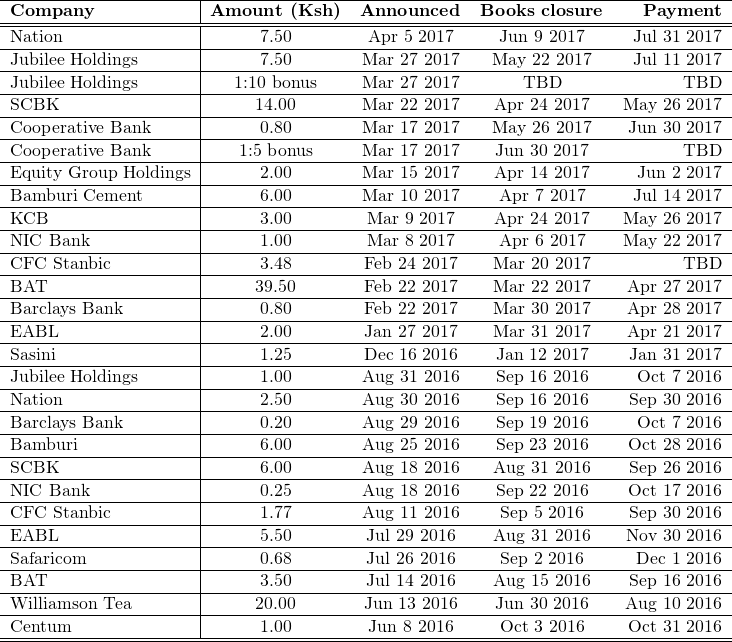

The table below lists some of the dividends announced in late 2016 and early 2017. Please note that this list is not exhaustive.

To use this reference:

- First, obtain your mobile money statements, your bank account statements, or both.

- Next, access your CDS account portfolio holdings for the dates covered in this table (you should be receiving automated emails from the stockbroker).

- For each dividend listed, verify the number of shares owned on the record date.

- Obtain your dividend payment by multiplying the number of shares owned by the dividend per share.

- Finally, cross-reference with your mobile money or bank account statement to see if you received the payment, less a 5% retained withholding tax.

Let’s work through another example.

On August 29 2016, BBK announced an interim dividend of Ksh 0.20 (this interim dividend added to the final dividend of Ksh. 0.80 means BBK paid Ksh 1.00 for the 2016 financial year). The books closure (ex-dividend date) for the interim dividend was September 19 2016. Looking at your CDS account statement, check how many BBK shares you owned on the ex-dividend date. Say you owned 1000 shares. You are then entitled to a dividend payment from BBK of Ksh 0.20 per share x 1000 shares = 200 Ksh. Verify if several days or weeks after October 7 2016 you received a payment of Ksh 190 from BBK. The Ksh 10 difference represents the 5% withholding tax.

Repeat this for all the dividends listed in the table, and for any other shares you own that are not listed here.

Conclusion

To sum up, we have discussed some important concepts regarding dividends, and worked through some examples illustrating how to calculate dividend income. One last note: stockbrokers and investment agents may assist clients by providing information related to dividend announcements. However, it is solely the investor’s responsibility to determine what dividends they will receive, and if they actually received them. Therefore, as an investor, please take some time to understand dividends, as they greatly increase the rate of return in your portfolio. Also, develop the habit of verifying receipt of all dividends owed to you.

In a future article, we will deal with two more events that get investors’ hearts beating faster: splits and bonuses. Until then, enjoy your dividends!